Notary

Delaware Notary Public

Embossing seal (raised stamp) and ink stamp used on all documentation

~ Contact us today! ~

This email address is being protected from spambots. You need JavaScript enabled to view it.

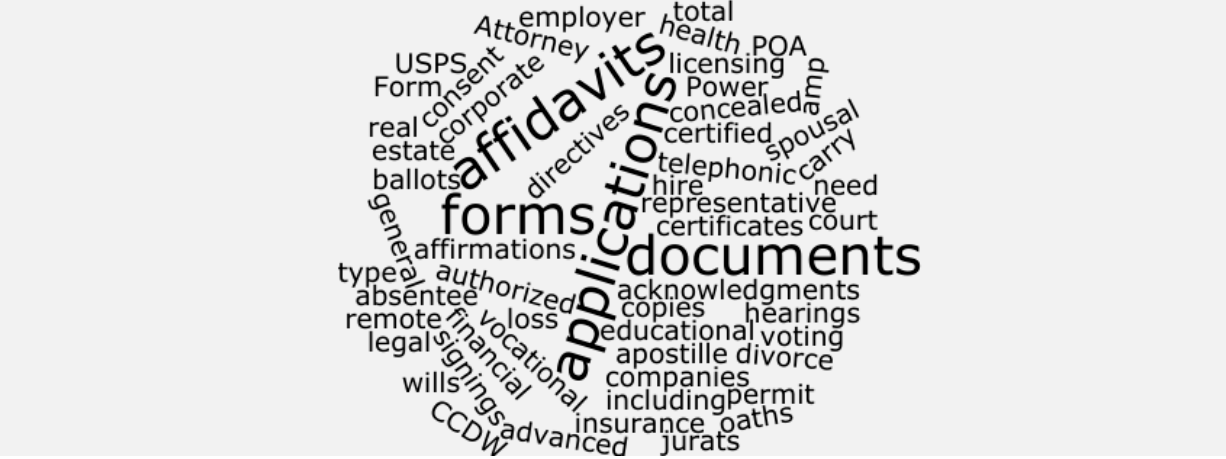

Commissioned independent Delaware Notary Public, approved and authorized to perform notarial acts in the State of Delaware, specializing in but not limited to:

certified copies of any type

POA (Power of Attorney)

divorce forms and documents

corporate documents

certificates in need of apostille

real estate signings

total loss affidavits for insurance companies

financial documents

legal documents

I-9 forms, including remote hire (authorized employer representative)

USPS Form 1583

licensing applications

vocational applications

educational applications

absentee voting ballots

concealed carry permit (CCDW) applications

spousal consent forms

general affidavits, acknowledgments & jurats

oaths and affirmations

telephonic court hearings

advanced health directives

wills

motor vehicle forms (click for DMV links)

Although best practice frameworks are available to guide adherence to compliance regulations, people are necessary to make it all happen. The roles of compliance strategy and implementation are evolving within enterprises with departments and C-Suite positions, including a dedicated compliance department who, along with the CCO, can be tasked with overseeing, planning, and managing elements that work towards IT compliance. Let’s take a closer look at the roles of a CCO and the overall compliance team.

Chief Compliance Officer (CCO): The CCO will be responsible for identifying and managing compliance risk, including developing internal and external controls to manage and resolve compliance problems. Oftentimes, a CCO will put a compliance department in place to provide complete compliance services to the business and staff.

Chief Technology Office (CTO): Unlike a CCO, the CTO oversees the entire technology framework and infrastructure including compliance, governance, and risk assessment.

Compliance Department: Our organization has a dedicated compliance department, charged with managing and overseeing compliance with all applicable regulations and mandates.

- Duties may include:

Risk identification

Implementing risk controls

Reporting on the effectiveness of controls

Resolving compliance problems

Providing regulatory advisement to the business

However, it should be noted that while the technical, procedural, and strategic management resides with those with the greatest liability risk (IT staff, CIO, CFO, and CEO), all constituents in the corporate structure are responsible for complying with the regulations that protect sensitive information.

Transition from Central Bank FIAT to Metal Backed TREASURY NOTES.

Regulation Information for ISO20022 Digital Currency.

What is ISO 20022?

- ISO 20022 is an international standard for relaying electronic messages between financial institutions. It was created to give the financial industry a common platform for sending payments messages and exchanging payments data, using a central dictionary, a standard modelling methodology, and a series of Extensible Markup Language (XML) and Abstract Syntax Notation (ASN.1 ) protocols.

- Banks and financial institutions globally are set to transition their payment systems from using SWIFT messages to the new, highly structured and data-rich ISO 20022 standard. By 2025 it will be the universal standard for high, or large-value payments systems of all reserve currencies, and will support 80% of transaction volumes - and 87% of transaction value globally. In Europe, SWIFT and the European Central Bank have announced ISO 20022 go-live dates of November 2022 for the standard

Why standardization is important?

- Standards are a critical factor when initiating financial transactions and reporting financial activity. An international standard is a way to simplify interoperability between service providers and clients, and enable the efficient, consistent and secure exchange of files.

- Traditionally, large global financial institutions have had tendencies to develop, approve and implement standards without seeking input from other organizations. This has resulted in inconsistency, and a lack of customization, leaving overwhelmed IT departments with the task of handling onboarding, testing and managing ongoing partner relationships.

- ISO 20022 was designed to remedy this, as a flexible framework providing an internationally agreed business message syntax, where user organizations and developers will use the same message structure, form and meaning to exchange transaction information globally.

What are the benefits of ISO 20022?

- Global adoption of ISO 20022 will create a common language and model for payments data. It will provide higher quality data which translates to better quality and faster payments for everyone involved in the payments chain.

- The implementation of ISO 20022 will create an open standard that can adapt to changing needs and new approaches within the payments industry. As it will not be controlled by a single interest, it can be used by anyone in the industry of financial services and implemented on any network.

~ Contact us today! ~

This email address is being protected from spambots. You need JavaScript enabled to view it.

Plan - Prepare - Respond

~

Pennsylvania

Tel: 215-694-0834

~

Delaware

Tel: 302-650-3153

- Hits: 20904